The RSPU ETF has received considerable attention from traders seeking exposure to the dynamic North American stock scene. Evaluating its historical performance, however, requires a thorough strategy.

While the ETF has demonstrated positive returns over the extended period, understanding its weaknesses is crucial for investors to make intelligent allocations.

A detailed review of RSPU's assets reveals a broad strategy that aims to track the performance of the broader stock index. This structure can provide investors with a fairly resilient avenue for engagement in the Canadian equity market.

However, it's crucial to analyze the volatility associated with any investment. Understanding factors such as economic conditions is essential for portfolio managers to make well-informed decisions.

By performing a get more info meticulous analysis, investors can gain valuable insights into the characteristics of the RSPU ETF and make more informed decisions.

Discovering Potential: Equal-Weight Utilities with RSPU

The utility sector often presents a diverse landscape, offering both growth and durability. Investors seeking to capitalize on this potential may consider an equal-weight approach. By assigning capital fairly across utilities, investors can minimize the impact of any single company's performance. The RSPU index provides a robust framework for implementing this strategy, providing exposure to a broad range of utility companies.

Investing in RSPU ETF for Steady, Defensive Gains

In today's treacherous market, investors are always searching for ways to earn steady returns while mitigating risk. The RSPU ETF presents a compelling opportunity for those seeking a strategic portfolio that focuses on defensive growth. This exchange-traded fund tracks a strategically curated index of corporations known for their stability. By putting money in RSPU, investors can potentially enjoy steady returns even during periods of market uncertainty.

- Additionally, the ETF's focus on time-tested businesses provides a layer of protection against market downswings.

- Ultimately, RSPU can be a valuable addition to any long-term investment strategy seeking both growth and resilience.

RSPU Fund Performance

The utility sector continues to be pillar of many investors' portfolios. The RSPU ETF, a popular choice for gaining exposure to this sector, has delivered impressive returns in recent years. Understanding the factors shaping the utility landscape is crucial for individuals looking to navigate on these opportunities. Furthermore, staying abreast of key indicators such as dividend yields can provide valuable insights for making strategic investment actions.

- Evaluate the dynamics driving recent performance in the utility sector.

- Assess the performance of the RSPU ETF over various time frames.

- Allocate capital across multiple asset sectors to mitigate exposure.

Analyzing the RSPU ETF's History

The RSPU ETF has attracted considerable attention from investors seeking diversification in the real estate sector. In order to understand its success, a thorough analysis of its historical track record is essential. Assessing key factors such as yield over various periods can provide valuable knowledge into the ETF's capabilities. Moreover, comparing its figures to relevant standards can shed light its competitive position.

Does the RSPU ETF Suit Your Investment Strategy?

The RSPU ETF has captured the attention of many investors looking for a diversified approach to the market. However, before you add it to your portfolio, it's important to understand its advantages and weaknesses. This ETF tracks an index that focuses on established companies in the U.S., offering potential for consistent returns. Additionally, RSPU offers exposure to a range of sectors, helping to balance your portfolio. But it's potential downsides should be weighed, such as fees.

- Ultimately, the decision of whether or not the RSPU ETF is right for you depends on your individual investment objectives and risk tolerance.

Luke Perry Then & Now!

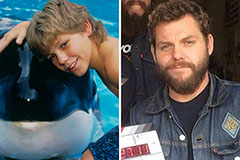

Luke Perry Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!